What’s become of Foster’s former wine business?

On the face of it, the former Foster’s wine business, Treasury Wine Estates (TWE), on 28 February 2013 posted disappointing half year results to the end of December 2012: net profits fell 23.2 percent to AUD 45 million (USD 45.9 million) and net sales dipped 3.4 percent to AUD 816.9 million, while EBIT dropped 20 percent to AUD 73.4 million and volumes slipped 2.5 percent to 16.5 million cases.

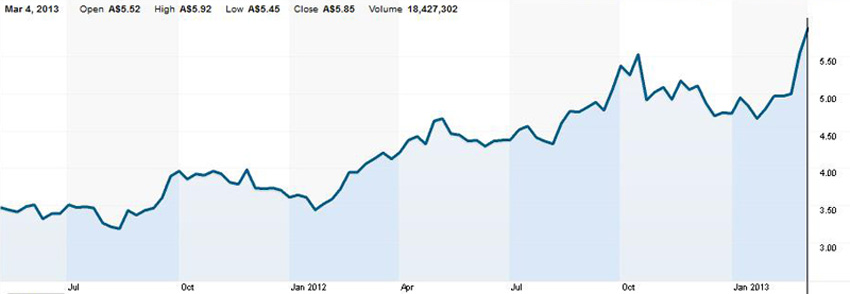

However, Treasury’s share price rose markedly following the results release. How can this be?

In May 2011, TWE officially began trading on the Australian Securities Exchange in Sydney, launching as a stand–alone wine company after separating from the Foster’s Group. Since then, Foster’s has been swallowed up by SABMiller, while TWE continues to focus on building a global wine business.

With brands such as Beringer, Lindeman’s, Penfolds, Rosemount and Wolf Blass, among others, TWE owns an impressive portfolio –54 brands in total, representing 32 million cases of wine sold – and ranks as the world’s number two wine company behind Constellation Brands in terms of volumes.

When TWE was spun out of the Fosters Group in May 2011, shares traded around the AUD 3.50 mark. Since then, shares have flirted with the AUD 5.50 mark, closing at AUD 5.52 on 7 March 2013, thus valuing TWE at AUD 3.8 billion.

Obviously, investors think that TWE can deliver growth – or a buyer for the business – or possibly both. Macquarie analyst Greg Dring was recently quoted as saying that TWE’s share price hike indicates the market expects "either a significant lift in earnings and/or a takeover" and has valued the company as high as AUD 4.2 billion.

There has been much speculation that TWE might hive off the Penfolds business into a separate company as part of a takeover defence. Analysts estimate that Penfolds alone accounted for as much as 50 percent of TWE’s pre–tax earnings despite generating only 5 percent of sales revenue. That’s why no one knows how much the other assets could be worth without Penfolds, so several industry experts are not convinced it’s a good idea to take out TWE’s best asset and leave a shell that is a lot less attractive. Many actually believe that, while the lure of owning the Penfolds brand is strong, there is still a lot of dead weight within the company.

In any case, TWE has not announced that it seeks a buyer or plans to spin off Penfolds.

Nevertheless, several factors seem to contribute to TWE’s present allure: for one, the oversupply problems, which have depressed the Australian wine industry for the past seven years, have disappeared as grape growers pulled out unprofitable vines, leaving a maximum capacity of about 1.6 million tonnes, all of which is needed to match current demand, reports say.

For another, wine prices in the U.S., Australia’s biggest export market in terms of value, are rising after more than a year of decline. Plus, it was reported that demand from China is continuing to surge, with purchases of Australian wine up 16.3 percent by volume and 23.1 percent by value over the 12 months to the end of September 2012.

What is more, new markets are opening up, while global supplies are nearing demand equilibrium, Dutch Rabobank wrote in an October 2012 report. Taken together these trends indicate that TWE could make for an attractive takeover target.

Now – who could buy TWE? There are few major listed wine companies and no obvious industry buyers. The big brewers and spirits groups tend to steer clear of wine and its volatile combination of agriculture and consumer brands.

Private equity, however, has played a role in the wine industry. The private equity firm Cerberus reportedly approached Foster’s in 2010 before TWE was even parcelled off with an offer valued at between AUD 2.3 billion and AUD 2.7 billion which Foster’s rejected – quite rightly so as TWE is worth much more today.

Therefore, several Australian media commentators concur that the eventual buyer of TWE could most likely be Chinese, as China has become the world’s fastest–growing wine market. Already, the Chinese are buying up wineries in Australia, such as the Gemtree and Stonehaven wineries in South Australia and Ferngrove in Western Australia in the past 18 months. In fact, Chinese investors with bankers in tow have been spotted in South Australia’s Barossa Valley and several wineries have told media that they are constantly being approached by Chinese investors wanting to buy them out.

Be that as it may, TWE’s CEO David Dearie has used his time at the helm well and increased the company’s focus on the fast–growing Asian market for export sales, particularly China, adding sales staff and enhancing its marketing effort. This seems to have paid off. On 28 February 2013 Mr Dearie said that TWE is now developing alternative packaging for wine given as gifts in China and using marketing developed for Asia, where profit margin was double that in other regions. Asian sales had a 30 percent margin on earnings before interest, tax, and adjustments for the value of vineyards, the Melbourne–based winemaker said.

By all accounts, Mr Dearie’s strategy is one of differentiating his company’s products by building up its market (and supply) of premium priced wines and entering fast–growing markets including Russia, India and Brazil. Many hope the company will be given enough time to rebuild the value of its brands and regain a good reputation after years of being much maligned as the dead weight on Foster’s.