SA Breweries steps up war of words

In the battle over market shares South African Breweries (SAB), a subsidiary of SABMiller, declared itself the winner. On 14 February 2012, Norman Adamai, Managing Director of SAB, said the brewer had recaptured the market it lost when one of its biggest brands, Amstel, was taken by competitor Brandhouse, the joint venture between Heineken, Diageo and Namibia Breweries.

In a rare departure from corporate etiquette never to comment on a competitor, Mr Adami told investors in London that Brandhouse’s strategy of turning Amstel into a mainstream brand had backfired and "undermined its historical premium credentials".

This was in contrast to SAB’s Castle Lite, which was half the size of Amstel in 2007 and had become a healthy competitor, he said.

In January 2012, SABMiller announced that lager volumes in South Africa had grown 2 percent in the three months to 31 December 2011, thanks to momentum gained from brands such as Castle Lite and Castle Lager.

Readers will remember that SAB brewed Amstel under licence until Heineken decided not to renew the contract. Brandhouse, which took over Amstel from SAB in 2007, has been fighting to regain the 9 percent market share for Amstel that SAB built up over decades.

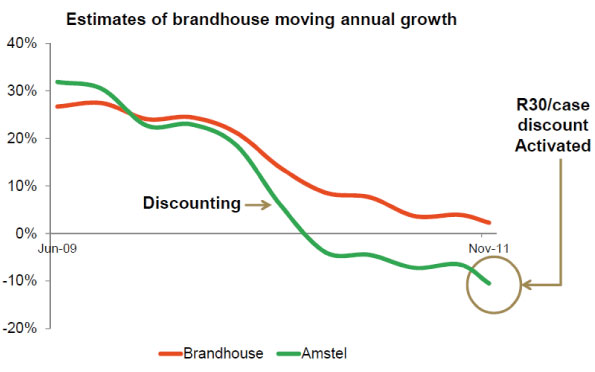

"The most significant impact on our business was the loss of the Amstel brand," Mr Adami said on 14 February. "It contributed 9 percent of beer volumes and about 20 percent of earnings before interest, tax, depreciation and amortisation. When it returned to the market in our competitor’s portfolio in late 2007, the brand was growing at 30 percent."

Brandhouse’s stated goal at the time was a 20 percent market share for its full portfolio, which seemed reasonable. This threat energised SAB to make real changes to its strategy, Mr Adami said. "Brandhouse has two of the most capable players in the beverage industry [Heineken and Diageo] so we took the threat very seriously."

In the two years since setting up brewing facilities in South Africa in March 2010, Brandhouse has seen a sharp drop in Amstel market share to 4.5 percent, says SAB.

Market observers attribute the loss to Brandhouse’s decision to significantly reduce the price of Amstel from the premium level, at which it had been marketed by SAB, to mainstream level. SAB’s response was to aggressively market Castle Lite and Carling Black Label.

Also, while SAB dedicated huge resources to beefing up its marketing and distribution, Brandhouse started to feel the restraints of its structure, which attempts to implement marketing and distribution strategies for three different drinks companies.

Not mincing words, Mr Adami described Brandhouse’s "momentum" as having been "interrupted" but noted that it was "regrouping". "The coming months will tell if that brand [Amstel] can recover," he said.

Mr Adami added that there has been a small resurgence in volumes after heavy discounting in December. "We have been disciplined on pricing of our premium brands. Pricing is the ultimate reflection of a brand’s strength. Castle Lite and Castle Milk Stout were testament to this." He said the company had increased the prices of these brands while growing volumes.

Since June 2010, SAB’s market share has hovered just under 90 percent. SAB contributes 23 percent to SABMiller’s profits (EBITA).