Premium’s performance is anything but mainstream

The dynamic growth of the premium and superpremium sectors has been one of the global Beer market’s key recent developments, reports Canadean.

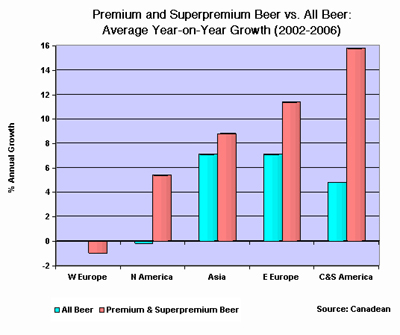

According to a special report from industry analysts Canadean, over the last five years, sales of premium and superpremium beers have grown by an average of 8 percent per annum and at twice the rate of discount and mainstream alternatives.

Driven by consumers and producers alike, this success can be attributed to a number of factors, says Canadean. Consumer tastes are changing and, armed with increasing disposable incomes, many consumers have ‘upgraded’ to the more expensive brands. There has also been a cultural shift away from the traditional ‘session’ drinking. Instead, there is a growing tendency for consumers to drink lower quantities of stronger beer.

Meanwhile, attracted by the higher margins, the major brewers have all added premium and superpremium beers to their portfolios. These brands have been targeted towards specific markets and supported strongly by extensive promotional campaigns.

Of the major brewers, the portfolios of Heineken and Carlsberg are influenced most heavily. Heineken has focused on its Premium Heineken and Amstel brands in addition to product and packaging innovations. Organic growth has been coupled with strategic acquisitions in developing markets. The purchase of BBAG, for example, has provided a strong presence in east and central Europe, bringing with it key premium brands such as Zipfer and Edelweiss.

Carlsberg was also quick to recognise the trend towards speciality brands and in 2004, introduced its Semper Ardens range. This was followed by the launch of the Jacobsen brand, produced at the new J.C. Jacobsen brewhouse in Copenhagen.

Strong potential in the USA and China…

On a market level, western Europe is the only region where consumption of premium and superpremium Beer is declining. In contrast, these sectors have grown steadily in the USA where they now account for almost 25 percent of total beer volumes. Importantly, this figure is still well below the 40 percent mark generally acknowledged to be the point of market maturity. Sales are however highly dependent on the health of the economy and the effects of the sub-prime crisis remain to be seen.

China, the world’s leading beer consumer, is a highly fragmented market. The only brands to have so far made a real impact are Pabst Blue Ribbon and Budweiser, both of which have benefited greatly from their early mover status. The booming Chinese economy has boosted disposable incomes and created a huge new middle class. As such, future prospects look bright.

Corona viewed differently at home…

Central and south America has been the most dynamic region, reports Canadean. Mexico alone accounts for over half of all premium and superpremium beer consumed and is unique in being dominated by one brand, namely Modelo. Interestingly, Mexican beer Corona Extra is the leading premium brand in the U.S. and the third best selling globally. However, at home it is not even thought of as a premium brand.

In eastern Europe, Russia is the star performer having experienced explosive growth since 2002. Buoyed by the efforts of major brewers such as BBH and the noticeable shift from spirits to beer and wine, the market has advanced by some 17 percent year-on-year, says Canadean.

Authors

Ina Verstl

Source

BRAUWELT International 2007