AB-InBev plans marketing blitz for nineteen new products this year

After three years of straight volume declines, AB-InBev thinks it’s got a plan. As the President of North American operations, the Brazilian-born Luiz Edmond, told the Wall Street Journal on 29 March 2012, the brewer will produce more beers this year, while leaning on its distributors not to carry the competition’s beers.

Already in November 2011, AB-InBev informed the more than 500 wholesalers who distribute their products across the U.S. that it wanted them to sell fewer rival brews. Because of the three tier system in the U.S., brewers and distillers cannot sell alcohol directly to the retailers but are required to distribute it through intermediaries.

The toughening rhetoric has made a growing number of wholesalers "anxious’’. They probably remember the old ways of Anheuser-Busch. In 1996 Anheuser-Busch launched a “100 percent share of mind” programme, which included some incentives to distributors so that they dropped non-A-B brands and concentrated on only the important A-B brands. The message to wholesalers in those days was: “We want their efforts and focus aligned with ours.”

Mr Edmund, in the interview with the Wall Street Journal, calls on the wholesalers’ loyalty. Wholesalers will have to decide which brewer they want to partner with most closely. "I’m loyal to my wholesalers. Why would I not expect the same loyalty to me?’’ Mr Edmund was quoted as saying.

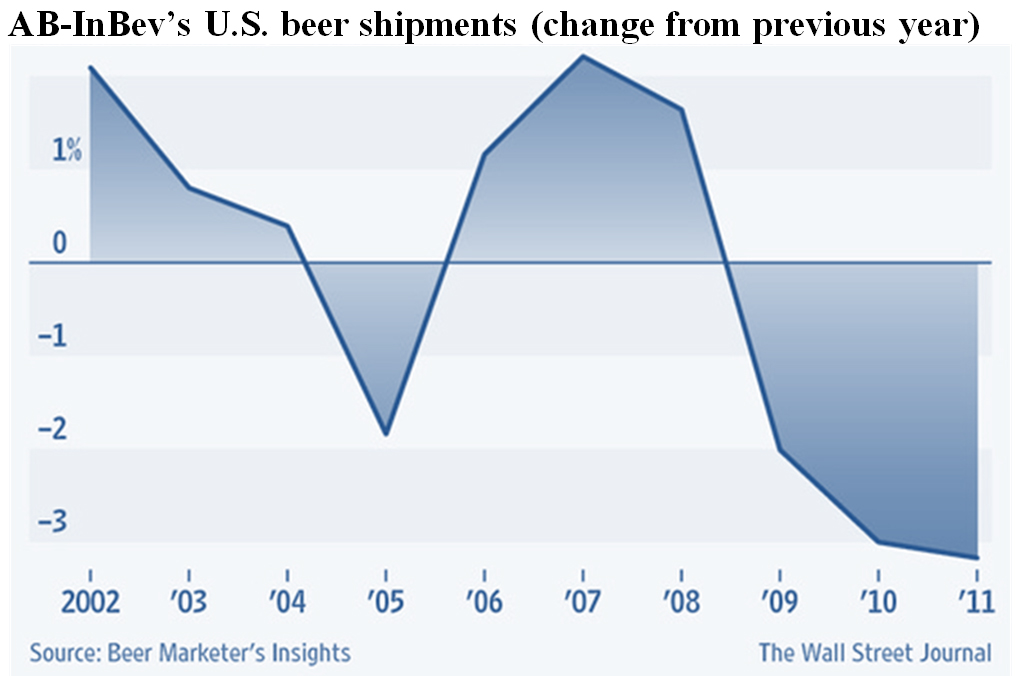

Although profits in the U.S. operations have kept up well over the past few years since the takeover of Anheuser-Busch, not least thanks to the Brazilians’ cost-cutting zeal and ability to raise prices, the merged company’s U.S. beer shipments have fallen, slipping below 100 million barrels (117 million hl) in 2011 for the first time since 2000.

Rising profits, coupled with declining volumes, would not have worried AB-InBev much. What is worrying to AB-InBev is the company’s decline in market share. After last year’s 3.2 percent drop in shipments, Anheuser’s share of the U.S. beer market has shrunk to 46.9 percent from 48.9 percent in 2008, according to Beer Marketer’s Insights, a trade publication.

The U.S. economy could finally climb out of recession this year. Still, Mr Edmond isn’t sure the company will sell more beer in the U.S. this year. All he is hoping for is that market-share losses will narrow.

AB-InBev is not the only big brewer who is struggling. Beer shipments at MillerCoors, the SABMiller-Coors joint venture and number two player, slumped 3.0 percent in 2011, as its market share dipped to 28.4 percent, according to Beer Marketer’s Insights.

The volume decreases of the big brewers coincide with production increases at the hundreds of small, independent U.S. craft brewers. Their volumes soared 13 percent in 2011, topping 10 million barrels (11.7 million hl) for the first time, according to the Brewers Association. The total U.S. beer market is roughly 200 million barrels (234 million hl).

AB-InBev is responding by expanding its palette of beverage offerings. New beers will be coming out this year but also several new products which have little to do with beer, for example a Bud Light Lime-a-Rita, an 8% ABV malt beverage, arriving in stores this month, which tastes like a Margarita cocktail. The company is expected to roll out a tea-and-lemonade drink in April and a cider in May, each containing 4% ABV, under the Michelob brand.

It also has stepped up marketing for Stella Artois, its biggest Belgian beer, shipments of which to U.S. retailers soared 24 percent last year to top one million barrels. Volumes of Goose Island, a smaller, Chicago-based craft brewer Anheuser bought last year for USD 39 million, grew more than 20 percent, the Wall Street Journal reported.

Nevertheless, Mr. Edmond said Bud Light and Budweiser, which together still represent more than half of the company’s U.S. volume sales, remain top priorities. AB-InBev is trying to stabilise Budweiser sales, as U.S. shipments have fallen for 23 straight years.